child tax credit payment schedule 2021

For tax year 2021 the Child Tax Credit increased from 2000. This is an up to 1400 per.

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

The IRS pre-paid half the total credit amount in monthly payments from.

. October 5 2022 Havent received your payment. Previously only children 16 and younger qualified. For more information about the Credit for Other Dependents see the instructions for Schedule 8812 Form 1040 PDF.

Six payments of the Child Tax Credit were and are due this year. Advance Child Tax Credit Payments in 2021. Wait 10 working days from the payment date to contact us.

What is the schedule for 2021. Changes to income limits. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Parents E-File to Get the Credits Deductions You Deserve. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Determine if you are eligible and how to get paid. This is a 2021 Child Tax Credit payment that may have been received monthly between July and December. The payments will be paid via direct deposit or check.

Ad Taxes Can Be Complex. The schedule of payments moving forward will be as follows. Up to 300 dollars or 250 dollars depending on age of child August 15 PAID.

Under the build back better act you generally wont receive monthly child. Child tax credit payment schedule 2022 ojogos from wwwojogosinfo. The complete 2021 child tax credit payments schedule.

Each payment will be up to 300 for each qualifying child. The payments will be paid via direct deposit or check. How much of the Child Tax Credit can I claim on.

IRS TREAS 310 TAXEIP3. Up to 300 dollars or 250. The payments will be paid via direct deposit or check.

Each payment will be up to 300 for each qualifying child under the age of 6 and up to 250 for each qualifying child from. For each qualifying child age 5 and younger up to 1800 half the total will come. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

All payment dates. The credits scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

IRS TREAS 310 CHILDCTC. This has been changed to 75000. Discover The Answers You Need Here.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. Recipients can claim up to 1800 per child under six this year split into the six. Each payment will be up to 300 for each qualifying child.

Prior to upping the child tax credit to 3000 and 3600 the income limits were around 200000 for most taxpayers. The schedule of payments moving forward is as follows. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per.

Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS.

Childctc The Child Tax Credit The White House

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Deadline To Apply For Ct S Child Tax Rebate Is Sunday

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

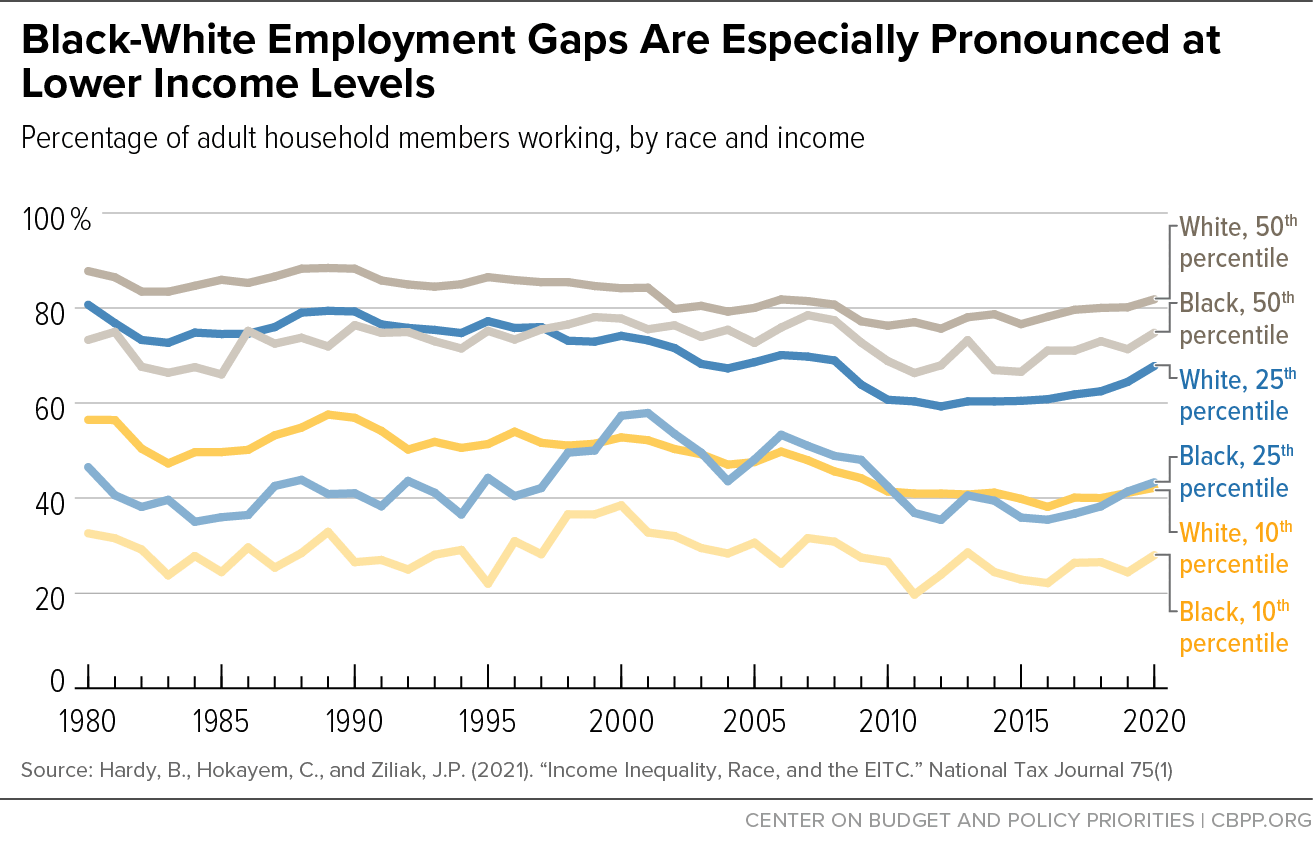

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Child Tax Credit Payments Will Start In July The New York Times

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Child Tax Credit Ctc Get Your Payment Il

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor