iowa inheritance tax changes 2021

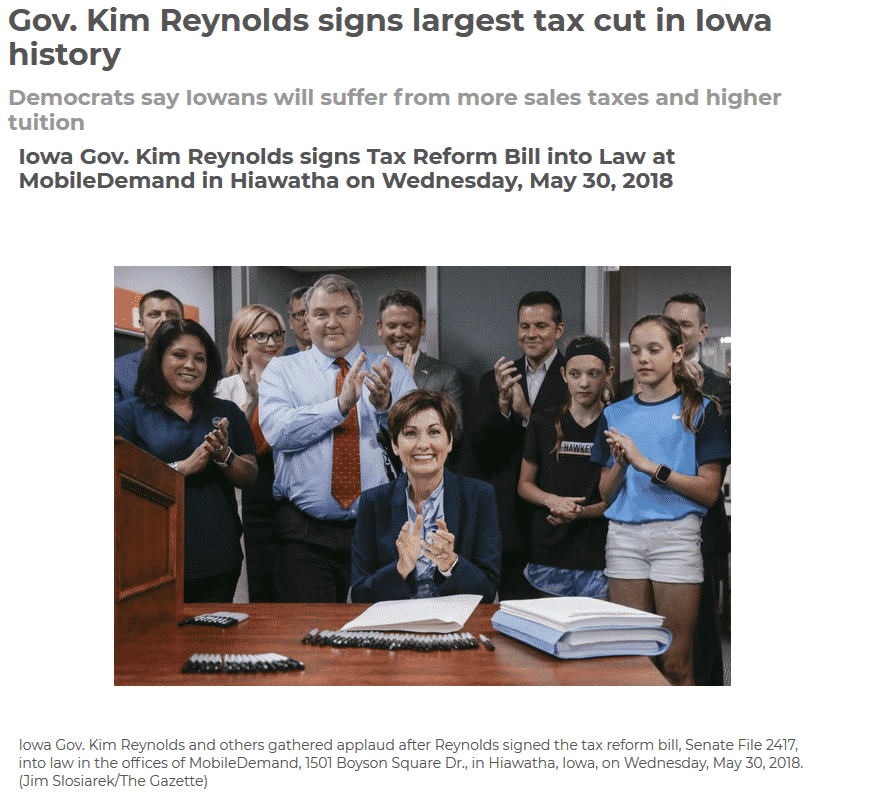

For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent. Kim Reynolds signed a massive tax law Wednesday that will accelerate income tax cuts phase out the inheritance tax and property tax backfill and fund the states mental health system through a state appropriation.

State Corporate Income Tax Rates And Brackets Tax Foundation

A state inheritance taxThe inheritance tax will be eliminated in the Hawkeye State over the next three years.

. In Iowa an inheritance tax return will have to be filed which will create a gross estate of. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. Iowa is already overcoming a lot of headwinds Reynolds said touting the states post-pandemic.

The 25000 maximum would become 300000 this year then would increase to 600000 and 1 million. For persons dying on or after January 1 2025 the Iowa inheritance tax is repealed. The Gross Estate in Iowa.

Learn About Property Tax. In the meantime there is a phase-out period before the tax completely disappears. Recent Changes to Iowa Estate Tax 2022 Iowa Inheritance Tax is Coming to an End by 2025.

The Iowa legislature recently passed a bill to repeal the Iowa Inheritance Tax. The applicable tax rates will be reduced an additional 20 for each of the following three years. Ad Inheritance Tax Forms Wills Trusts and More.

For deaths occurring on or after. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original rates. An inheritance tax is only imposed against the beneficiaries that receive property or money from the decedent.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Soon one element wont be a consideration in estate planning in Iowa. Kim Reynolds signed the bill into law on June 16 2021The bill also accelerates income tax cuts and funds the states mental health system through a state appropriation.

The applicable tax rates will be reduced an additional 20 for each of the following three years. Iowa continues tax reform efforts into 2021. Children parents grandparents and other direct descendants or ancestors of the deceased are exempt.

Some of these changes are significant including reductions in the personal income tax a phase out of the states inheritance tax and an exemption for cancellation of indebtedness income under the. Change or Cancel a Permit. A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024.

Under the former law which will be in effect until December 31 2024. Those individuals that die on or after January 1 2021 also receive some. The bill would gradually raise the size of an estate exempted from the tax.

Up to 25 cash back master2022-04-19_10-08-26. Iowa was one of just six states in the country to still impose an inheritance tax. Official Iowa Last Will and Testament Template.

Register for a Permit. Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. On May 19th 2021 the Iowa Legislature similarly passed SF.

Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. The Iowa Senate passed 46 to 0 a bill that would eliminate the inheritance tax and remove revenue triggers holding back income tax cuts passed in.

Over four years beginning for estates of decedents passing on or after January 1 2021 the tax rate is reduced ultimately eliminating the inheritance tax for deaths on or after January 1 2025. On June 16 2021 Iowa Gov. Changes in and Updates to Certain Tax Credit Programs.

Beginning in 2021 the bill would allow bonus depreciation and an expanded Beginning Farmer Tax Credit. However it is the duty of the personal representative to see that the tax is collected and paid. Iowa has decided to end their inheritance tax starting in 2021 and.

As discussed later Iowas statutory definition of net income would be modified starting on January 1 2023 as a result of removing contingent income tax triggers. 1 SF 619 would couple Iowa tax law with federal bonus depreciation for qualified assets purchased on or after January 1 2021. Anything that is payable to the estate upon death is not included in the calculation of inheritance tax in Iowa and anything payable to a beneficiary such as a life insurance policy is subject to the inheritance tax depending on the.

Iowa has historically decoupled from federal bonus depreciation. It is phased in with reductions for the first few years but on January 1 2025 the Iowa Inheritance Tax will be fully repealed assuming Governor Reynolds signs the bill SF619. Inheritance tax is a tax on the share going to a beneficiary and it is the beneficiary who is responsible for payment of the tax.

When payment in full has been received by the Iowa Department of Revenue an inheritance tax clearance will be issued. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. For persons dying in the year 2024 the Iowa inheritance tax will be reduced by eighty percent.

Kim Reynolds signed into law Senate File 619 making various changes to the states tax code. Track or File Rent Reimbursement. Inheritance Tax Rates Schedule.

Repeal of State Inheritance Tax. The inheritance tax kicks in on inheritances of 25000 or more. Learn About Sales.

Exclusion from Income for COVID-19 Grants. File a W-2 or 1099. Spouses children and even parents were already excluded from paying the inheritance tax while nieces.

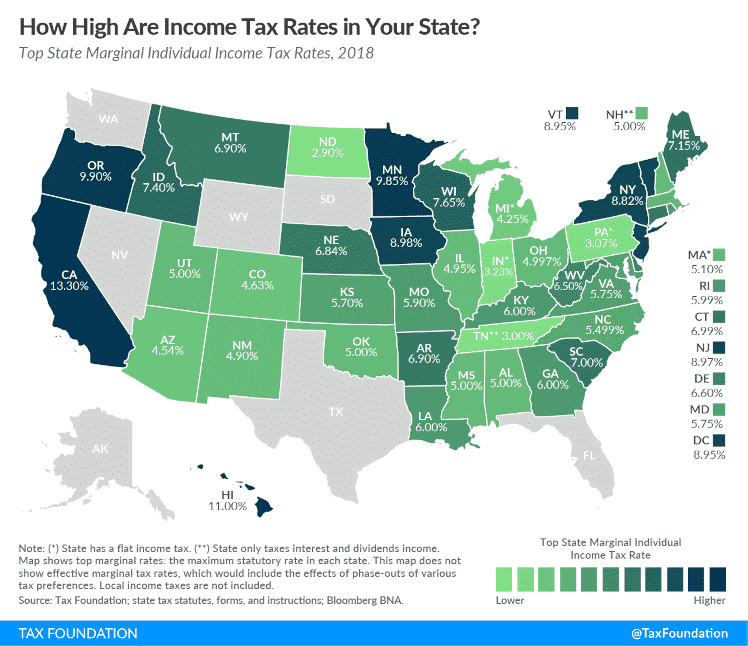

House File 841 passed out of subcommittee Monday afternoon. But that looks to be coming to an end. Other provisions such as lower tax rates and a phase-out of the Iowa inheritance tax will not be fully implemented for several years.

How To Avoid Inheritance Tax In Iowa

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Recent Changes To Iowa Estate Tax 2022

Iowa Income Tax Calculator Smartasset

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

New Record 26 000 Acre Iowa Farmland Sale Record Amount Of Land Could Flood Market In Next 60 Days Agweb

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Iowa Inheritance Tax Law Explained

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management